HOW TO E-FILE FORM 941 SCHEDULE R

- Create your free account.

- Choose either “CPEO or 3504 Reporting Agent” option to proceed.

- Enter your “Organization Information” such as Name, EIN, and Address.

- Select "File Aggregate Form 941 (Schedule R)" from the dashboard.

- Select the “Tax Year” and “Quarter” that you're filing for.

- Enter your businesses' wages, tax withholdings, and deposit details.

- Add each client's wages, tax withholdings, and deposit details.

- Follow the interview style process to complete your return.

- Review your form summary, and transmit it directly to the IRS.

Who must File Form 941 Schedule R?

CPEOs/PEOs

The CPEOs/PEOs files an aggregate return for all the clients, using the CPEO’s EIN and they can file all those returns listed

on Form 8973.

CPEOs/PEOs use Form 8973 to notify the IRS that a service agreement between a CPEO and a customer has

started or ended.

Section 3504 Agents

The Section 3504 Agents files an aggregate return for all the clients using the 3504 agent’s EIN and they can file all those returns listed on Form 2678.

3504 Agents Use Form 2678 to request approval to appoint an agent for tax reporting, depositing, and paying or revoke an existing appointment.

The IRS has Mandated Electronic Filing

The Mandate Certification from the IRS affects the employment tax liabilities of both the CPEOs / 3504 Reporting Agent and its clients, as it requires them to file all their tax forms electronically on behalf of their clients.

Either 1 or 100,000 clients. We have a solution that helps you to meet your mandate e-filing requirements with the IRS. Get started now with our e-filing solution by signing up for free.

Know more about our product by visiting www.taxbandits.com! We offer the features that benefits you.

Features that benefits CPEOs / PEOs & Section 3504 Agents

Easy to Use Dashboard Access

Multiple Data Integration Methods

Provide Access to Multiple Users

Enhanced Client Management

Bulk file your 941 Schedule R with one of these method

Bulk Upload

Conveniently upload client data through 941 Bulk Upload Templates (Excel or CSV files).

API Integration

Expand your existing software and conveniently file your tax forms by integrating our API solution.

Custom Programming

Migrate your clients data from your existing system with little to no manual work.

Manual Entry

Enter client data one by one using our interview-style process.Experience the same Efiling Features

Yes. We also support the other federal Forms which are required for the CPEOs/PEOs and Section 3504 Agents. The following are the Forms that you can also file with our e-filing solution.

Required Information for Filing Form 941 Schedule R

Employer Details of the CPEO / Section 3504 Agent:

- Name, EIN, and Address

Employment Details of the Aggregate Filer and their Clients:

- Total Medicare and Social Security Tax Withheld

- Total Deposit Made to the IRS

- Total Tax Liability (Monthly/Semiweekly)

- Signing Authority Information, Online Signature PIN or Form 8453-EMP

Form 941 Schedule R Quarterly E-Filing Deadlines

If you are an aggregate filer, file your aggregate Form 941 (Schedule R) every quarter before the deadline mentioned below.

| Tax Period | Quarterly E-Filing Deadlines |

|---|---|

| January - March | First Quarter April 30, 2024 |

| April - June | Second Quarter July 31, 2024 |

| July - September | Third Quarter October 31, 2024 |

| October - December | Fourth Quarter January 31, 2025 |

Click here to learn more about Schedule R (Form 941) deadline.

https://www.taxbandits.com/form-941/form-941-due-date/

Its simple and free to get started with our 941 Schedule R e-filing solution.

FORM 941 SCHEDULE R: ALLOCATION SCHEDULE FOR AGGREGATE FORM 941

The Schedule R (Form 941) to simplify the reporting process for employers, aggregate filers and the IRS. It will provide the IRS with client-specific information to support the totals reported on an aggregate Form 941 Tax. It includes an allocation line for each client showing a breakdown of their wages and employment tax liability for the tax period. This allows the IRS to reconcile the information for each client with the aggregate totals on the face of the Form 941.

Certified Professional Employer Organizations (CPEOs) or PEOs and Section 3504 Agents have to file an aggregate Form 941, with

Schedule R (Form 941) attached, if they are reporting wages on behalf of their clients.

CPEOs/PEOs and Section 3504 Agents should file all their tax forms electronically on behalf of their clients to effectively manage their employment tax liabilities as well as their clients.

Meet the IRS mandate e-filing with our enhanced solution and stay compliant. Get Started Now.

About 941 SCHEDULE R Efiling Solution

We at 941scheduler.com, designed a cloud based tax filing solution for CPEOs/PEOs and Section 3504 Reporting Agent which helps them in meeting their mandate electronic filing requirements without any trouble.

Either you have 1 or 100,000 clients. You can upload and verify all your clients data into our system by choosing one of the data integration method that we offer. The built-in error system within our e file system will locate each incomplete and inconsistent information of your clients and ensure that the tax forms transmitted with the IRS are error free.

And at anytime during the filing process, if you have any queries, reach out to our customer support team either by phone or email. We have a team of people who are ready to assist you. Our support team is located and operating from Rock Hill, South Carolina ensuring our clients get 100% U.S based customer support.

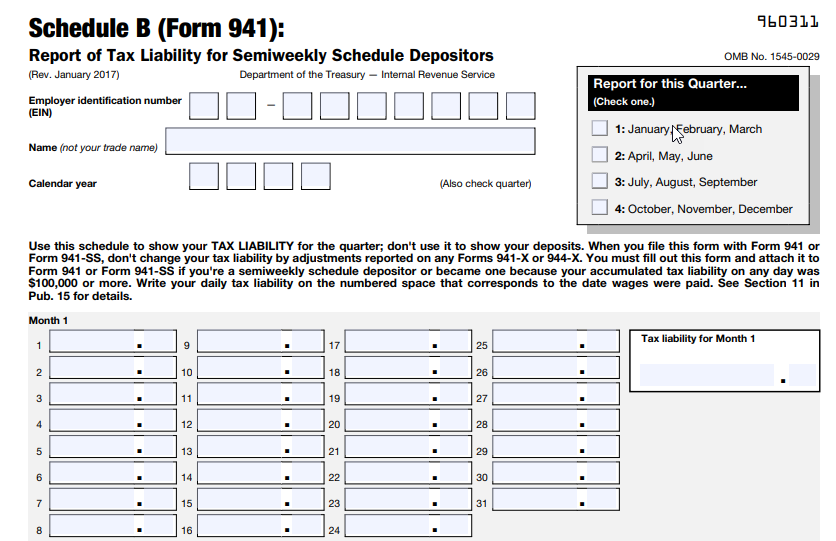

Schedule B (Form 941)

schedule b (form 941)

schedule b is used to report the tax liability for semiweekly pay schedules. it should be completed and submitted with the irs form 941 if you’re a semiweekly depositor.

click here https://www.taxbandits.com/form-941/form-941-schedule-b/ to learn more about form 941 schedule b

Helpful Resources

IRS Revised Form 941 for Second Quarter of 2021 Learn more

Contact Us

E-mail at support@TaxBandits.com

Call at 704.839.2321

We are here to support you directly from 941ScheduleR.com, 2685 Celanese Road, Suite 100, Rock Hill, SC 29732.

How to Align Form 941 and W-2 for Accurate

Payroll Reporting?

To align Form 941 and Form W-2 for accurate payroll reporting, it’s essential to ensure the wages and taxes reported on each quarterly Form 941 match the totals reported on Form W-2. Any discrepancies can lead to IRS issues, so verifying consistency between both forms is crucial.

With TaxBandits, you can easily file both Form 941 and Form W-2 Online on the same platform, streamlining the process of tracking and reconciling your payroll information.

Form W-9: Request for Taxpayer Identification Number

and Certification

Invite your vendors to complete and

e-sign W-9

Form W-9 is an IRS tax form used by an individual or entity to request a person's name, address, Taxpayer Identification Number (TIN) and certification from a hired contractor or vendor to e-file the 1099 information returns. IRS Form W9 is known as Request For Taxpayers Identification Number and Certification Form.

With TaxBandits online portal, employers can request form W9 online and manage all W-9 forms at one place securely. Sign up now and request the first FIVE Form W-9 for FREE.